Paolo's Blog Random thoughts of a Junior Computer Scientist

Modeling Financial Markets as MDPs

We know that games can be modeled using Markov decision processes and thus be solved using Reinforcement learning algorithms. Can the same reasoning be applied to the financial market? Can financial markets be treated as a game where the utility function is to make more money as possible?

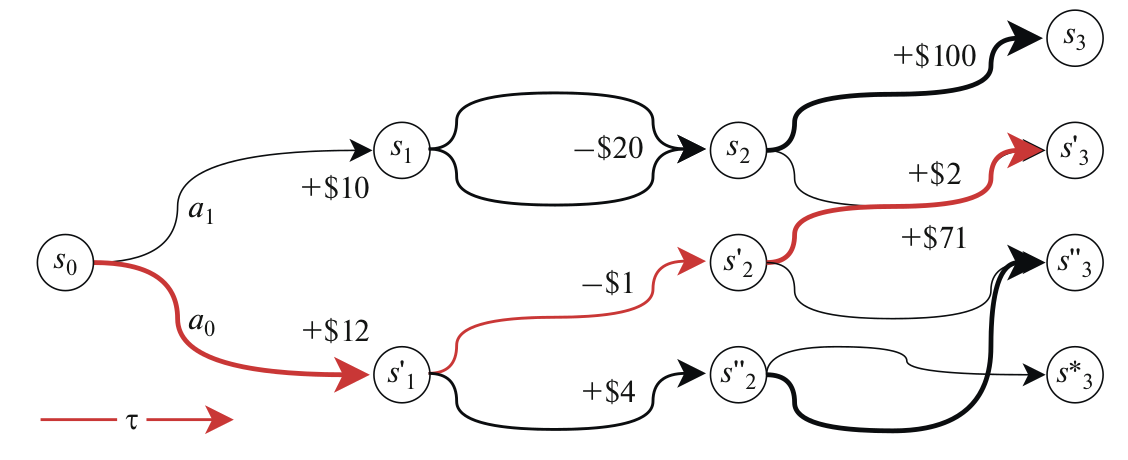

Recent papers told us so. Even though financial markets are not a game, their mechanics can be approximated with a Markov decision process. At each time step \(t \), the agent receives some representation of the environment denoted by S_t. Given this state, an agent chooses an action \( A_t \) and based on this action, a numerical reward \( R_{t+1} \) is given to the agent at the next time step, and the agent finds itself in a new state \( S_t+1 \). The interaction between the agent and the environment produces a trajectory tau. At any time step \( t \), the goal of an RL is to maximize the expected return denoted as \( G_t \) at time \( t \). It is empirically proven that financial assets are extremely dependent on newer events than past events. This is another point on the reasons why financial markets can be modeled with a Markov process: they satisfy the Markov property. The Markov property formally can be defined as:

\[\mathbb{P}[S_{t+1} | S_t] = \mathbb{P}[S_{t+1} | S_t, ..., S_1]\]the conditional probability distribution of future states of the process depends only upon the present state, not on the sequence of events that preceded it. This is always the case with financial markets as they tend to always look forward to what is likely to happen in the future.

The state-space in the case of financial markets is usually represented using the OHLCV data with the addition of various technical indicators of the past n-th days of the target security. The usual technical indicators included are the MACD, the RSI, the ATR, and various moving averages. To make the agent aware of its position on the market and the current PnL, a vector that encodes this kind of information can also be included in the state space. All those data points can be put together in a vectorized fashion and used as the input of the neural net.

Regarding the action space, there are two main ways of implementation: discrete action space: where a simple action set of {-1, 0, 1} (or other types of encoding) is used, to represent sell, hold, and buy action respectively. continuous action space: allow actions to be any value between -1 and 1.

The trickiest part of a reinforcement learning environment to design is the reward function. This could be simply equal to the returns (or log-returns) of the agent trade, which are given only when the agent closes a trade. Or the reward function can be designed to take into account also the risk of each trade. Finding the right reward function might be also based on the goals that want to be obtained by the agent. Giving the plain returns can be a valid option if the goal is to merely optimize the profit, while if the goal is also to obtain a less volatile equity line the reward function must take the risks into account. Consequently, it can be concluded that there is no single way to design a reward function, everyone has to design it according to the set objectives.

To make a concrete example let’s suppose that our environment is the crude oil continuos future.

Let’s also suppose that our agent is going to act on daily candles. Apart from the OHLCV data,

we want to include two moving averages (a 50-period MA and a 200-period MA), the RSI, the ATR,

and a positional encoding of the day and month variables. Since we would like to

leverage the implied volatility (implied volatility is one of the only financial data that is forward-looking)

on this asset we also would like to include the OHLC data of the OVX index,

which is the volatility index of the crude oil futures.

Fixing the input state to the previous 21 trading days at each step we got a input data similar to the following:

open high low close MA Smoothing Line MA.1 Smoothing Line.1 Volume Volume MA ATR RSI RSI-based MA open_ovx high_ovx low_ovx close_ovx day_sin day_cos month_sin month_cos

Date

2007-05-11 61.89 62.56 61.68 62.37 62.28530 62.40756 62.5848 62.57444 216920 228967.65 1.595914 46.550818 50.353979 26.41 26.41 26.41 26.41 7.431448e-01 -0.669131 5.000000e-01 -0.866025

2007-05-14 62.43 63.07 62.14 62.46 62.23140 62.34749 62.6012 62.58312 200433 227399.15 1.548348 46.999236 49.685978 27.23 27.23 27.23 27.23 2.079117e-01 -0.978148 5.000000e-01 -0.866025

2007-05-15 62.54 63.30 62.07 63.17 62.17525 62.28898 62.6632 62.60072 185334 225779.35 1.525609 50.525568 48.967185 27.89 27.89 27.89 27.89 1.224647e-16 -1.000000 5.000000e-01 -0.866025

2007-05-16 63.15 63.30 61.90 62.55 62.11345 62.23031 62.7004 62.62540 216160 225719.05 1.516637 47.550389 48.298946 27.07 27.07 27.07 27.07 -2.079117e-01 -0.978148 5.000000e-01 -0.866025

2007-05-17 62.62 65.09 62.48 64.86 62.05870 62.17282 62.7612 62.66216 267955 228258.40 1.594734 57.574277 48.023056 24.86 24.86 24.86 24.86 -4.067366e-01 -0.913545 5.000000e-01 -0.866025

2007-05-18 65.90 66.44 65.59 65.98 62.01130 62.11802 62.8480 62.71480 168618 228173.60 1.593682 61.423777 48.273097 24.71 24.71 24.71 24.71 -5.877853e-01 -0.809017 5.000000e-01 -0.866025

2007-05-21 65.94 67.10 65.28 66.87 61.97185 62.06611 62.9844 62.79144 192779 228295.70 1.609848 64.203327 49.123527 24.67 24.67 24.67 24.67 -9.510565e-01 -0.309017 5.000000e-01 -0.866025

2007-05-22 66.80 67.00 65.40 65.51 61.91450 62.01396 63.1164 62.88208 201705 225693.85 1.609144 57.397494 49.690902 26.03 26.03 26.03 26.03 -9.945219e-01 -0.104528 5.000000e-01 -0.866025

2007-05-23 65.61 66.20 65.05 65.77 61.86180 61.96363 63.2732 62.99664 230829 227269.20 1.576348 58.307411 50.458624 26.35 26.35 26.35 26.35 -9.945219e-01 0.104528 5.000000e-01 -0.866025

2007-05-24 65.72 66.15 63.82 64.18 61.80095 61.91208 63.3936 63.12312 212993 227268.00 1.630180 51.117194 51.038639 26.63 26.63 26.63 26.63 -9.510565e-01 0.309017 5.000000e-01 -0.866025

2007-05-25 64.48 65.30 64.21 65.20 61.75695 61.86121 63.5466 63.26284 144492 223578.50 1.593739 54.954752 52.004388 25.81 25.81 25.81 25.81 -8.660254e-01 0.500000 5.000000e-01 -0.866025

2007-05-29 64.98 65.24 62.54 63.15 61.70095 61.80703 63.6180 63.38956 221016 223358.60 1.672758 46.973199 52.136539 27.83 27.83 27.83 27.83 -2.079117e-01 0.978148 5.000000e-01 -0.866025

2007-05-30 63.26 63.87 62.88 63.49 61.65075 61.75428 63.6938 63.50504 215024 220918.55 1.623989 48.314002 52.549657 28.61 28.61 28.61 28.61 -2.449294e-16 1.000000 5.000000e-01 -0.866025

2007-05-31 63.31 64.27 62.43 64.01 61.60555 61.70303 63.7890 63.60820 275955 222738.50 1.639419 50.380481 53.019423 28.44 28.44 28.44 28.44 2.079117e-01 0.978148 5.000000e-01 -0.866025

2007-06-01 64.23 65.25 63.80 65.08 61.57150 61.65714 63.8984 63.70916 225803 223350.60 1.625889 54.418871 53.581427 27.39 27.39 27.39 27.39 2.079117e-01 0.978148 1.224647e-16 -1.000000

2007-06-04 64.87 66.48 64.53 66.21 61.55225 61.61620 63.9888 63.79760 228630 223155.85 1.649039 58.280530 54.387234 27.36 27.36 27.36 27.36 7.431448e-01 0.669131 1.224647e-16 -1.000000

2007-06-05 66.05 66.20 65.23 65.61 61.51980 61.57997 64.0554 63.88508 200804 220771.10 1.601251 55.587605 54.748808 26.70 26.70 26.70 26.70 8.660254e-01 0.500000 1.224647e-16 -1.000000

2007-06-06 65.67 66.31 65.21 65.96 61.48310 61.54644 64.1164 63.96960 222155 217995.55 1.565447 56.840399 55.412380 25.94 25.94 25.94 25.94 9.510565e-01 0.309017 1.224647e-16 -1.000000

2007-06-07 65.90 67.42 65.82 66.93 61.45225 61.51578 64.1964 64.05108 275768 218017.05 1.567915 60.191871 55.599351 26.11 26.11 26.11 26.11 9.945219e-01 0.104528 1.224647e-16 -1.000000

2007-06-08 66.70 66.83 64.56 64.76 61.41725 61.48493 64.2100 64.11340 284370 219387.15 1.625207 50.705761 54.833778 26.51 26.51 26.51 26.51 9.945219e-01 -0.104528 1.224647e-16 -1.000000

2007-06-11 64.70 66.07 64.52 65.97 61.38530 61.45154 64.2088 64.15740 234653 220273.80 1.619835 54.967498 54.174076 25.99 25.99 25.99 25.99 7.431448e-01 -0.669131 1.224647e-16 -1.000000

If we are using a recurrent net this 21x21 input is fine, while if the agent is using a fully connected network this data must be squeezed into a single vector.

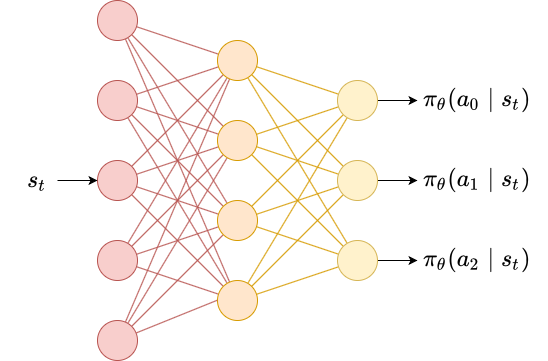

In this environment, only three actions are possible: buy a fixed fraction of the asset (1), sell a fixed fraction of the asset (2), or hold (0). So in case, the policy is parametrized \( \pi_{\theta} \) at each step a probability distribution over its actions is given \( \pi_{\theta}(A | S_t) \). The figure below shows an example.

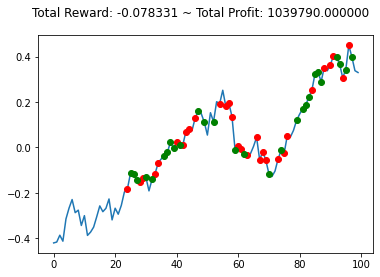

Assuming that our risk appetite is high, we can design a reward function that is going to maximize the returns no matter what. Let \( cp \) the price of the traded asset at the current step \( i \), and let \( ltp \) the last traded price that is the price we the agent have opened a trade. If the agent position is a long position the current step reward is given by the log-returns that the agent could get by closing the trade:

\[stepreward = \log(\frac{cp}{ltp})\]similarly, if the agent position is a short position the current step reward is

\[stepreward = \log(\frac{ltp}{cp})\]Here’s an example of how our env could work using the openai gym library:

observation = env.reset()

while True:

action = env.action_space.sample()

observation, reward, done, info = env.step(action)

if done:

print("info:", info)

break

Resulting in:

There are few libraries that implement a Trading environment that can be used for RL algo:

- FinRL: an open-source library for deep reinforcement learning in finance by AI4Finance Foundation. It’s a well-documented library with over 5.6k stars on GitHub.

- gym-anytrading: is a collection of OpenAI Gym environments for reinforcement learning-based trading algorithms. It’s a pretty simple and lightweight library that you could also use to extend the base class and make your own env.

- gym-anytrading-2.0: my fork of

gym-anytrading, where I reimplemented the baseTradingEnvclass in my own way. The main differences from the original projects are in the way the rewards are calculated, position sizing logic has been added, and theHoldaction has been added. Further modifications have been planned to make the env even more flexible. Contributors are welcome!

But as pointed out by Tidor-Vlad Pricope in trading, our training, backtesting, and live environments can become so different that we can’t really make any guarantees. Those envs are just for research purpouses and they have to be treated for what they are, and what they can accomplish.

References

- Deep Reinforcement Learning for Trading

- Capturing Financial markets to apply Deep Reinforcement Learning

- Deep Reinforcement Learning in Quantitative Algorithmic Trading: A Review