Paolo's Blog Random thoughts of a Junior Computer Scientist

Building a NG strategy with a Random Forest Regressor

Is it possible to teach an ML model to trade?

The short answer is yes. But how well the model will perform with data it has never seen before?

That’s the big problem with machine learning and also with trading strategies. As we don’t want a trained model to overfit the training data we also don’t want a trading strategy to overfit the in-sample data. The keyword here is robustness. What we are looking for both in trading and machine learning is to build a generalized model. In the case of trading, this means performing well in different assets classes with the same price setup. While In the case of machine learning, this means that our model is not “memorizing” training data, but rather it is “learning” to generalize from a trend.

For more information about the notebook and the data, this is the official github repo.

import warnings

warnings.filterwarnings('ignore')

%matplotlib inline

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

from matplotlib.ticker import FuncFormatter

from mpl_toolkits.mplot3d import Axes3D

import seaborn as sns

from sklearn.model_selection import BaseCrossValidator

from sklearn.metrics import make_scorer

from sklearn.ensemble import RandomForestRegressor, \

GradientBoostingRegressor, AdaBoostRegressor

from sklearn.tree import DecisionTreeRegressor

from sklearn.model_selection import cross_val_score

from scipy.stats import spearmanr

dataset_path = '../data/model_data.h5'

Load Data

The dataset is not only composed by OHLCV data, but I’ve also incorporated:

- fundamental data such as the consuption of NG, the storage, …

- technical indicators data such as the RSI, MACD, the ATR, …

- the $n$ lagged returns where $n \in {1, 5, 10, 21, 63}$

- the $n$ forward returns which are the target variables

- variables that are referring to year, month, and weekday

Since I’ve decided to test out Tree based model, I’m going to use this data as I would do for a tipical machine learning task. So the model won’t have a notion of time, just like timeseries model.

data = pd.read_hdf(dataset_path, 'no_dummies')

data = data.drop([c for c in data.columns if 'lag' in c], axis=1)

data

| Close | Volume | Open | High | Low | Consumption in mcf | Storage in mcf | US Gross Withdrawal in mcf | Other Gross Withdrawal in mcf | RSI | ... | return_21d | return_42d | return_63d | target_1d | target_5d | target_10d | target_21d | year | month | weekday | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | |||||||||||||||||||||

| 2012-04-09 | 2.107 | 108772.0 | 2.103 | 2.117 | 2.065 | 1953071.0 | 2478.0 | 2417498.0 | 93400.0 | 34.901425 | ... | -0.003584 | -0.003797 | -0.005916 | -0.036070 | -0.015267 | -0.006449 | 0.007501 | 2012 | 4 | 0 |

| 2012-04-10 | 2.031 | 120126.0 | 2.111 | 2.125 | 2.025 | 1953071.0 | 2478.0 | 2417498.0 | 93400.0 | 30.556017 | ... | -0.006397 | -0.004436 | -0.006230 | -0.023634 | -0.008005 | 0.001807 | 0.009692 | 2012 | 4 | 1 |

| 2012-04-12 | 1.983 | 188668.0 | 1.976 | 2.068 | 1.972 | 1953071.0 | 2478.0 | 2417498.0 | 93400.0 | 28.170441 | ... | -0.006395 | -0.005282 | -0.006237 | -0.001009 | -0.007785 | 0.002641 | 0.011266 | 2012 | 4 | 3 |

| 2012-04-13 | 1.981 | 111947.0 | 1.982 | 1.999 | 1.959 | 1953071.0 | 2503.0 | 2417498.0 | 93400.0 | 28.072097 | ... | -0.007064 | -0.005306 | -0.005330 | 0.017668 | -0.005512 | 0.009896 | 0.009795 | 2012 | 4 | 4 |

| 2012-04-16 | 2.016 | 115321.0 | 1.986 | 2.030 | 1.977 | 1953071.0 | 2503.0 | 2417498.0 | 93400.0 | 32.512260 | ... | -0.005926 | -0.004447 | -0.004609 | -0.032242 | -0.000894 | 0.012604 | 0.010299 | 2012 | 4 | 0 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 2021-08-24 | 3.896 | 54557.0 | 3.929 | 3.970 | 3.884 | 2218011.0 | 2851.0 | 3396062.0 | 32500.0 | 50.393336 | ... | -0.002451 | 0.003121 | 0.004626 | 0.000257 | 0.023556 | 0.023485 | 0.011719 | 2021 | 8 | 1 |

| 2021-08-25 | 3.897 | 37979.0 | 3.900 | 3.991 | 3.858 | 2218011.0 | 2851.0 | 3396062.0 | 32500.0 | 50.456830 | ... | -0.000895 | 0.002589 | 0.004246 | 0.073646 | 0.034399 | 0.025870 | 0.013270 | 2021 | 8 | 2 |

| 2021-08-26 | 4.184 | 64362.0 | 3.917 | 4.217 | 3.896 | 2218011.0 | 2851.0 | 3396062.0 | 32500.0 | 64.500602 | ... | 0.001622 | 0.003632 | 0.005519 | 0.044455 | 0.020949 | 0.016707 | 0.014884 | 2021 | 8 | 3 |

| 2021-08-27 | 4.370 | 3899.0 | 4.202 | 4.397 | 4.197 | 2218011.0 | 2871.0 | 3396062.0 | 32500.0 | 70.363841 | ... | 0.003522 | 0.004427 | 0.006063 | -0.014874 | 0.015184 | 0.018147 | 0.013912 | 2021 | 8 | 4 |

| 2021-08-30 | 4.305 | 161299.0 | 4.499 | 4.526 | 4.222 | 2218011.0 | 2871.0 | 3396062.0 | 32500.0 | 66.246073 | ... | 0.004544 | 0.003937 | 0.005205 | 0.016725 | 0.011930 | 0.020237 | 0.011532 | 2021 | 8 | 0 |

2351 rows × 25 columns

data.info()

<class 'pandas.core.frame.DataFrame'>

DatetimeIndex: 2351 entries, 2012-04-09 to 2021-08-30

Data columns (total 25 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 Close 2351 non-null float64

1 Volume 2351 non-null float64

2 Open 2351 non-null float64

3 High 2351 non-null float64

4 Low 2351 non-null float64

5 Consumption in mcf 2351 non-null float64

6 Storage in mcf 2351 non-null float64

7 US Gross Withdrawal in mcf 2351 non-null float64

8 Other Gross Withdrawal in mcf 2351 non-null float64

9 RSI 2351 non-null float64

10 ATR 2351 non-null float64

11 MACD 2351 non-null float64

12 return_1d 2351 non-null float64

13 return_5d 2351 non-null float64

14 return_10d 2351 non-null float64

15 return_21d 2351 non-null float64

16 return_42d 2351 non-null float64

17 return_63d 2351 non-null float64

18 target_1d 2351 non-null float64

19 target_5d 2351 non-null float64

20 target_10d 2351 non-null float64

21 target_21d 2351 non-null float64

22 year 2351 non-null int64

23 month 2351 non-null int64

24 weekday 2351 non-null int64

dtypes: float64(22), int64(3)

memory usage: 477.5 KB

def get_X_y(data: pd.DataFrame):

columns_to_drop = ['Open', 'Close', 'Low', 'High', 'Volume']

y = data.filter(like='target')

X = data.drop(columns_to_drop, axis=1)

X = X.drop(y.columns, axis=1)

return X, y

X, y = get_X_y(data)

Now that we have out X and y let’s split the data in a trainig set and test set.

The test won’t only be used for testing the final model, but it will be also used for the backtesting part.

X, X_test, y, y_test = X.loc['2012':'2019'], X.loc['2019':'2021'], y.loc['2012':'2019'], y.loc['2019':'2021']

f'Train lenght: {len(X)}', f'Test length: {len(X_test)}'

('Train lenght: 1932', 'Test length: 671')

class MultipleTimeSeriesCV(BaseCrossValidator):

"""Generates tuples of train_idx, test_idx pairs"""

def __init__(self,

n_splits=3,

train_period_length=126,

test_period_length=21,

lookahead=None,

shuffle=False):

self.n_splits = n_splits

self.lookahead = lookahead

self.test_length = test_period_length

self.train_length = train_period_length

self.shuffle = shuffle

def split(self, X, y=None, groups=None):

unique_dates = X.index.get_level_values('Date').unique()

days = sorted(unique_dates, reverse=True)

split_idx = []

for i in range(self.n_splits):

test_end_idx = i * self.test_length

test_start_idx = test_end_idx + self.test_length

train_end_idx = test_start_idx + self.lookahead - 1

train_start_idx = train_end_idx + self.train_length + self.lookahead - 1

split_idx.append([train_start_idx, train_end_idx,

test_start_idx, test_end_idx])

dates = X.reset_index()[['Date']]

for train_start, train_end, test_start, test_end in split_idx:

train_idx = dates[(dates.Date > days[train_start])

& (dates.Date <= days[train_end])].index

test_idx = dates[(dates.Date > days[test_start])

& (dates.Date <= days[test_end])].index

if self.shuffle:

np.random.shuffle(list(train_idx))

yield train_idx, test_idx

def get_n_splits(self, X=None, y=None, groups=None):

return self.n_splits

n_splits = 15

train_period_length = 300

test_period_length = 100

lookaheads = [1, 5, 10, 21]

# Utilities functions

def display_score(scores):

print('scores: ',scores)

print('mean: ', scores.mean())

print('standard deviation: ', scores.std())

def rank_correl(y, y_pred):

return spearmanr(y, y_pred, axis=None)[0]

ic = make_scorer(rank_correl)

def get_cross_val_score(model, X, y, score_fun, cv, n_jobs=-1):

cv_score = cross_val_score(estimator=model,

X=X,

y=y,

scoring=score_fun,

cv=cv,

n_jobs=n_jobs,

verbose=1)

display_score(cv_score)

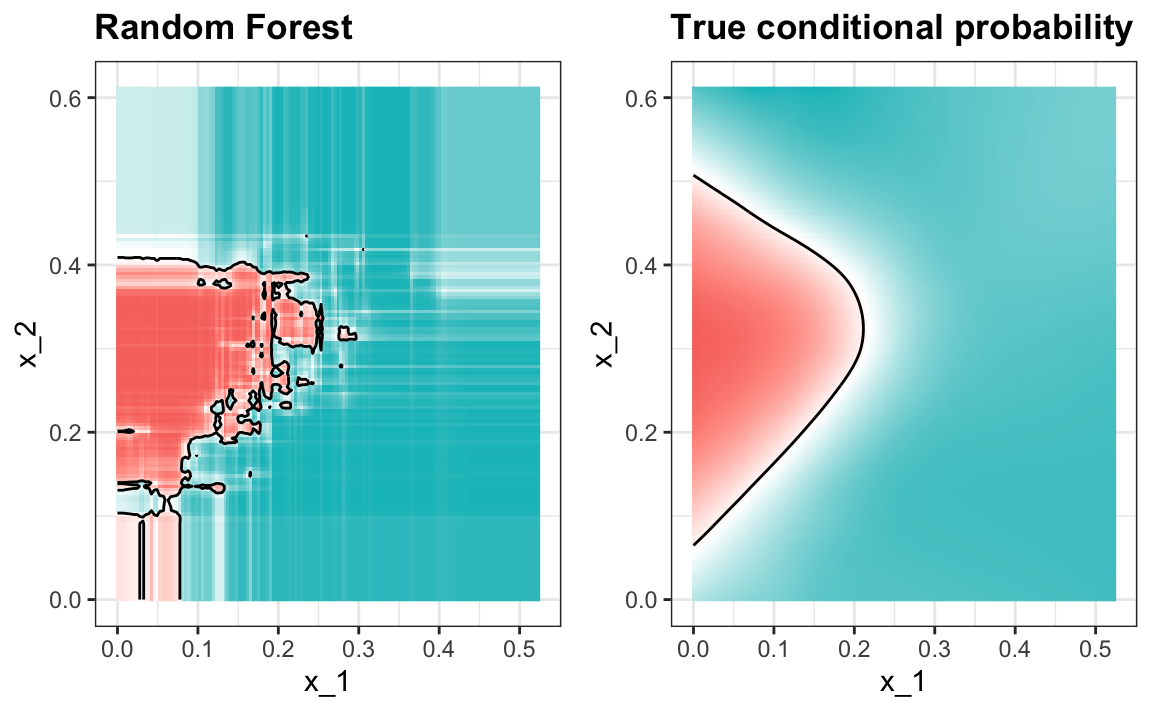

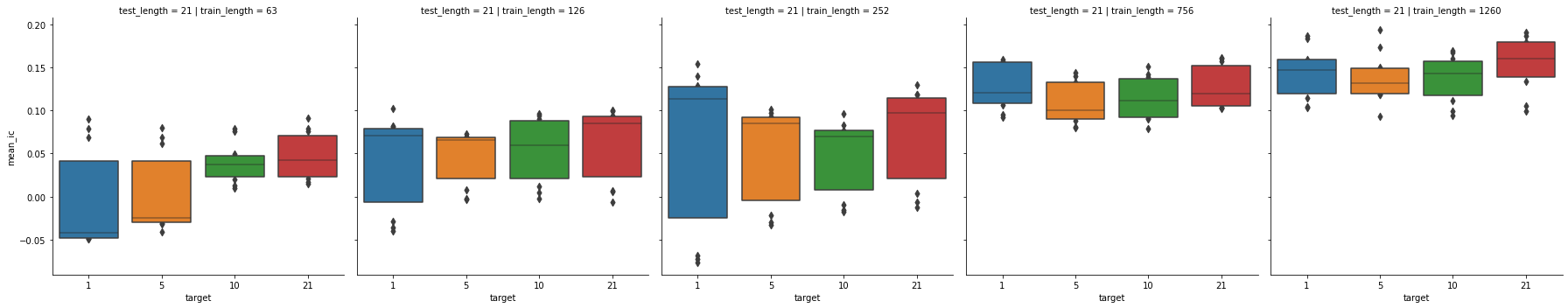

The scoring function that we are going to use to test out the models is the spearman correlation $\rho$. But why are we using this kind of correlation in first place?

Unlike the tipical loss function that are used in machine learning, the spearman correlation assesses how well the relationship between two variables can be described usign a monotonic function.

If the pearson correlation gives a perfect value when $X$ and $Y$ are related by a linear function, the spearman correlation results when $X$ and $Y$ are related by any monotonic function.

Here’s and example:

Form the image above we can see that the spearman correlation is high even though there isn’t a linear correlation between $X$ and $Y$. In fact we can intuitevily see that $Y = \sqrt{c X}$

Let’s now test out which is the best tree model using the spearman correlation as a scoring function.

Decision Tree Regressor

dt_reg = DecisionTreeRegressor(max_depth=None,

min_samples_split=2,

min_samples_leaf=1,

max_features='auto')

for lookahead in lookaheads:

cv = MultipleTimeSeriesCV(n_splits=n_splits,

train_period_length=train_period_length,

test_period_length=test_period_length,

lookahead=lookahead)

print(f'lookhead: {lookahead}')

get_cross_val_score(dt_reg, X, y, ic, cv)

print('\n')

lookhead: 1

[Parallel(n_jobs=-1)]: Using backend LokyBackend with 3 concurrent workers.

[Parallel(n_jobs=-1)]: Done 15 out of 15 | elapsed: 2.6s finished

[Parallel(n_jobs=-1)]: Using backend LokyBackend with 3 concurrent workers.

scores: [-0.13101391 0.15451854 0.18070339 -0.0562517 -0.03433135 0.06979087

0.09453872 0.11061872 -0.04106021 0.11633454 0.18392795 0.14913466

0.02506414 0.0346177 0.16230884]

mean: 0.06792672580348139

standard deviation: 0.09463351327402522

lookhead: 5

[Parallel(n_jobs=-1)]: Done 10 out of 15 | elapsed: 0.3s remaining: 0.1s

[Parallel(n_jobs=-1)]: Done 15 out of 15 | elapsed: 0.3s finished

[Parallel(n_jobs=-1)]: Using backend LokyBackend with 3 concurrent workers.

[Parallel(n_jobs=-1)]: Done 10 out of 15 | elapsed: 0.1s remaining: 0.1s

[Parallel(n_jobs=-1)]: Done 15 out of 15 | elapsed: 0.2s finished

[Parallel(n_jobs=-1)]: Using backend LokyBackend with 3 concurrent workers.

scores: [-0.20927668 0.04604246 0.09179215 -0.08948434 0.05706104 0.12117565

0.09213837 0.05793836 -0.01934843 0.11038874 -0.01854846 -0.08714146

0.14893241 0.04732402 -0.06412406]

mean: 0.018991318379871048

standard deviation: 0.0951334842919218

lookhead: 10

scores: [-0.19912898 0.12238416 0.04419881 -0.1036148 0.07946813 0.02062854

0.06730263 0.30685917 0.0606858 0.1000542 -0.06519469 -0.04041847

0.05410469 0.08347365 0.00963497]

mean: 0.03602918631257569

standard deviation: 0.11040736275079402

lookhead: 21

scores: [-0.10136783 0.08902033 0.1383936 0.09122781 0.03461467 -0.06061215

-0.02665178 0.0537336 0.08048373 -0.03661694 0.04605128 0.01691698

0.02963777 -0.06728841 -0.03722724]

mean: 0.01668769340217639

standard deviation: 0.06682570728253841

[Parallel(n_jobs=-1)]: Done 10 out of 15 | elapsed: 0.1s remaining: 0.1s

[Parallel(n_jobs=-1)]: Done 15 out of 15 | elapsed: 0.1s finished

Random Forest Regressor

rf_reg = RandomForestRegressor(n_estimators=100,

max_depth=None,

min_samples_split=2,

min_samples_leaf=1,

min_weight_fraction_leaf=0.0,

max_features='auto',

max_leaf_nodes=None,

min_impurity_decrease=0.0,

bootstrap=True,

oob_score=False,

n_jobs=-1,

random_state=None,

verbose=0,

warm_start=False)

for lookahead in lookaheads:

cv = MultipleTimeSeriesCV(n_splits=n_splits,

train_period_length=train_period_length,

test_period_length=test_period_length,

lookahead=lookahead)

print(f'lookhead: {lookahead}')

get_cross_val_score(rf_reg, X, y, ic, cv)

print('\n')

[Parallel(n_jobs=-1)]: Using backend LokyBackend with 3 concurrent workers.

lookhead: 1

[Parallel(n_jobs=-1)]: Done 15 out of 15 | elapsed: 4.4s finished

[Parallel(n_jobs=-1)]: Using backend LokyBackend with 3 concurrent workers.

scores: [-0.13863668 0.30713462 0.28466835 -0.09170711 0.11769505 0.15852962

0.08962024 0.15531941 0.04524835 0.15721646 -0.00053663 0.14467668

0.07360171 0.12293946 0.18112238]

mean: 0.10712612712307454

standard deviation: 0.1163415452886651

lookhead: 5

[Parallel(n_jobs=-1)]: Done 15 out of 15 | elapsed: 3.1s finished

[Parallel(n_jobs=-1)]: Using backend LokyBackend with 3 concurrent workers.

scores: [-1.60942756e-01 2.85937238e-01 2.85947202e-01 -3.43541538e-02

9.48986556e-02 1.59270620e-01 1.02904417e-01 1.50913881e-01

1.65938568e-04 1.28500090e-01 1.22980144e-02 1.83860871e-01

8.17587610e-02 1.23204020e-01 1.59399434e-01]

mean: 0.10491748226609333

standard deviation: 0.11283350114033273

lookhead: 10

[Parallel(n_jobs=-1)]: Done 15 out of 15 | elapsed: 4.6s finished

[Parallel(n_jobs=-1)]: Using backend LokyBackend with 3 concurrent workers.

scores: [-0.15371946 0.31925742 0.2579257 -0.0432299 0.08924062 0.09395159

0.18299472 0.15148163 0.05348772 0.09191036 0.04119813 0.12714026

0.10451165 0.10017288 0.04291752]

mean: 0.09728272234414333

standard deviation: 0.10868445700120122

lookhead: 21

scores: [-0.07855662 0.2605627 0.17725544 0.10996082 0.10711267 0.02077194

0.08216481 0.11132113 0.07765269 0.04165095 0.02646954 0.08661731

0.09749236 0.1256451 0.09840193]

mean: 0.08963485163230227

standard deviation: 0.07259440406955318

[Parallel(n_jobs=-1)]: Done 15 out of 15 | elapsed: 3.6s finished

Gradient Boosting Regressor

grad_reg = GradientBoostingRegressor(n_estimators=250,

max_depth=None,

min_samples_split=2,

min_samples_leaf=1,

min_weight_fraction_leaf=0.0,

max_features='auto',

max_leaf_nodes=None,

min_impurity_decrease=0.0,

random_state=None,

verbose=0,

warm_start=False)

for lookahead in lookaheads:

cv = MultipleTimeSeriesCV(n_splits=n_splits,

train_period_length=train_period_length,

test_period_length=test_period_length,

lookahead=lookahead)

print(f'lookhead: {lookahead}')

get_cross_val_score(grad_reg, X, y[f'target_{lookahead}d'], ic, cv)

print('\n')

[Parallel(n_jobs=-1)]: Using backend LokyBackend with 3 concurrent workers.

lookhead: 1

[Parallel(n_jobs=-1)]: Done 15 out of 15 | elapsed: 5.9s finished

[Parallel(n_jobs=-1)]: Using backend LokyBackend with 3 concurrent workers.

scores: [-0.20445306 0.01328533 0.16203015 -0.00838286 0.02444644 0.19617162

-0.00039004 0.01285329 0.02569495 0.28550855 0.01215722 -0.05161132

0.10326464 0.18349835 -0.02442244]

mean: 0.048643387344077575

standard deviation: 0.1160384340548671

lookhead: 5

[Parallel(n_jobs=-1)]: Done 15 out of 15 | elapsed: 4.8s finished

[Parallel(n_jobs=-1)]: Using backend LokyBackend with 3 concurrent workers.

scores: [-0.39282189 0.05045305 -0.02626936 -0.20777678 -0.01662166 0.11324502

-0.06610281 0.21798576 -0.05822539 0.09680168 0.17827997 -0.06715872

0.14292229 0.00322832 -0.04282028]

mean: -0.004992052919846818

standard deviation: 0.14981225481196084

lookhead: 10

[Parallel(n_jobs=-1)]: Done 15 out of 15 | elapsed: 4.6s finished

[Parallel(n_jobs=-1)]: Using backend LokyBackend with 3 concurrent workers.

scores: [-0.30514475 0.26224452 0.04842499 0.00207621 0.15526646 0.2469607

0.12970897 -0.04288132 0.49446886 -0.00571257 0.24380204 -0.15146387

0.09441372 0.20837809 -0.22545455]

mean: 0.07700583284484216

standard deviation: 0.20151505597435154

lookhead: 21

scores: [-0.16522151 -0.39272963 0.2310718 0.19308731 0.27021902 0.43274657

-0.4213874 -0.55196416 0.23484019 -0.04939124 -0.10160734 -0.11212755

-0.02024669 0.20687669 0.46304047]

mean: 0.014480434762936234

standard deviation: 0.29996516102650683

[Parallel(n_jobs=-1)]: Done 15 out of 15 | elapsed: 2.8s finished

It seems like that the most robust learner is the RandomTreesRegressor, since there is not much deviation using the

various targets. Let’s fine tune it in order to find the bests parameters

Hyperparamter Options

n_estimators = [100, 250]

max_depth = [5, 15, None]

min_samples_leaf = [5, 25, 100]

from itertools import product

cv_params = list(product(n_estimators,

max_depth,

min_samples_leaf))

n_cv_params = len(cv_params)

n_cv_params

18

sample_proportion = .6

sample_size = int(sample_proportion * n_cv_params)

cv_param_sample = np.random.choice(list(range(n_cv_params)),

size=int(sample_size),

replace=False)

cv_params_ = [cv_params[i] for i in cv_param_sample]

print('# CV parameters:', len(cv_params_))

# CV parameters: 10

Train/Test Period Lenghts

YEAR = 252

train_lengths = [5 * YEAR, 3 * YEAR, YEAR, 126, 63]

test_lengths = [5, 21]

test_params = list(product(train_lengths, test_lengths))

n_test_params = len(test_params)

print('# period params: ', n_test_params)

# period params: 10

Run cross-validation

labels = sorted(y.columns)

features = X.columns.tolist()

lookaheads = [1, 5, 10, 21]

label_dict = dict(zip(lookaheads, labels))

cross_val_cols = [

'train_length',

'test_length',

'n_estimators',

'max_depth',

'min_samples_leaf',

'mean_ic',

'std_ic',

'rounds',

'target'

]

cross_val_results = pd.DataFrame(columns=cross_val_cols)

run_cross_val = False

if run_cross_val:

for lookahead in lookaheads:

for train_length, test_length in test_params:

n_splits = int(7 * YEAR / (train_length + test_length))

res_row = dict(zip(cross_val_results, [None] * len(cross_val_results)))

cv = MultipleTimeSeriesCV(n_splits=n_splits,

test_period_length=test_length,

train_period_length=train_length,

lookahead=lookahead)

res_row['target'] = lookahead

res_row['train_length'] = train_length

res_row['test_length'] = test_length

for p, (n_estimator, max_d, min_s_l) in enumerate(cv_params_):

base_params = rf_reg.get_params()

model = RandomForestRegressor(base_params)

model_params = {

'n_estimators': n_estimator,

'max_depth': max_d,

'max_features': 'log2',

'min_samples_leaf': min_s_l

}

model = model.set_params(**model_params)

cval_score = cross_val_score(

estimator=model,

X=X,

y=y,

cv=cv,

n_jobs=-1,

scoring=ic

)

for k, v in model_params.items():

res_row[k] = v

res_row['mean_ic'] = cval_score.mean()

res_row['std_ic'] = cval_score.std()

res_row['rounds'] = len(cval_score)

cross_val_results = cross_val_results.append(res_row, ignore_index=True)

print(f'Lookback: {lookahead}, Train size: {train_length}, Test size: {test_length} ' + \

f'# estimators: {n_estimator}, max depth: {max_d}, min samples leaf: {min_s_l}, ic: {cval_score.mean()}')

save = False

if save:

cross_val_results.to_hdf('./rf_cross_val_results.h5', 'res', mode='w')

load = True

if load:

cross_val_results = pd.read_hdf('./rf_cross_val_results.h5', 'res')

cross_val_results.drop('max_features', axis=1, inplace=True)

cross_val_results.head()

| mean_ic | std_ic | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | mean | std | min | 25% | 50% | 75% | max | count | mean | std | min | 25% | 50% | 75% | max | ||

| train_length | test_length | ||||||||||||||||

| 63 | 5 | 40.0 | -0.040000 | 0.081078 | -0.137663 | -0.097139 | -0.082502 | 0.038680 | 0.106099 | 40.0 | 0.312388 | 0.013639 | 0.284262 | 0.300236 | 0.311043 | 0.325020 | 0.345137 |

| 21 | 40.0 | 0.019963 | 0.047568 | -0.049312 | -0.028885 | 0.025526 | 0.063457 | 0.091317 | 40.0 | 0.137543 | 0.030329 | 0.092126 | 0.109741 | 0.132114 | 0.158911 | 0.204503 | |

| 126 | 5 | 40.0 | -0.001472 | 0.062014 | -0.138518 | -0.040070 | -0.000937 | 0.053062 | 0.099942 | 40.0 | 0.317845 | 0.014023 | 0.286717 | 0.309783 | 0.317301 | 0.326947 | 0.344797 |

| 21 | 40.0 | 0.052328 | 0.042210 | -0.040017 | 0.007511 | 0.067954 | 0.082744 | 0.101916 | 40.0 | 0.158644 | 0.034644 | 0.101250 | 0.124148 | 0.153635 | 0.185232 | 0.225217 | |

| 252 | 5 | 40.0 | 0.013732 | 0.083639 | -0.174116 | -0.013137 | 0.031104 | 0.071588 | 0.134798 | 40.0 | 0.311959 | 0.016541 | 0.268482 | 0.301258 | 0.313738 | 0.319613 | 0.352641 |

| 21 | 40.0 | 0.059629 | 0.064671 | -0.076905 | -0.007141 | 0.083836 | 0.105530 | 0.153957 | 40.0 | 0.168644 | 0.042207 | 0.090941 | 0.116665 | 0.187859 | 0.200833 | 0.218862 | |

| 756 | 5 | 40.0 | 0.093385 | 0.039002 | 0.006339 | 0.060498 | 0.098753 | 0.126201 | 0.152640 | 40.0 | 0.315169 | 0.020823 | 0.274168 | 0.299033 | 0.318346 | 0.328555 | 0.364217 |

| 21 | 40.0 | 0.119656 | 0.025969 | 0.079235 | 0.099342 | 0.115937 | 0.140064 | 0.161495 | 40.0 | 0.188850 | 0.009080 | 0.168275 | 0.184229 | 0.190082 | 0.194146 | 0.210536 | |

| 1260 | 5 | 40.0 | 0.093835 | 0.043284 | 0.001723 | 0.064281 | 0.107727 | 0.127938 | 0.167663 | 40.0 | 0.324773 | 0.018168 | 0.287751 | 0.312535 | 0.325990 | 0.338086 | 0.363679 |

| 21 | 40.0 | 0.143335 | 0.029459 | 0.093199 | 0.118507 | 0.146548 | 0.163117 | 0.193948 | 40.0 | 0.206358 | 0.015252 | 0.173556 | 0.197984 | 0.207888 | 0.216628 | 0.233334 | |

Hyperparameters Analysis

Now that we have our cross validation results, let’s see which hyperparameters combination gives us the best results in various target periods.

First thing first, we would like to understand which train and test period lengths gives the best results. We can do it

by grouping by the train_length and test_length.

tt_lenght_res = cross_val_results.groupby(by=['train_length', 'test_length'])

tt_lenght_res.describe()

| mean_ic | std_ic | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | mean | std | min | 25% | 50% | 75% | max | count | mean | std | min | 25% | 50% | 75% | max | ||

| train_length | test_length | ||||||||||||||||

| 63 | 5 | 40.0 | -0.067284 | 0.125394 | -0.238227 | -0.198366 | -0.060339 | 0.040526 | 0.175820 | 40.0 | 0.323679 | 0.038303 | 0.247583 | 0.291036 | 0.332345 | 0.355690 | 0.389807 |

| 21 | 40.0 | 0.013003 | 0.045987 | -0.059556 | -0.031805 | 0.020466 | 0.051996 | 0.087472 | 40.0 | 0.141557 | 0.029460 | 0.102602 | 0.110236 | 0.143732 | 0.159184 | 0.204857 | |

| 126 | 5 | 40.0 | 0.037978 | 0.095936 | -0.179574 | -0.037138 | 0.068006 | 0.099740 | 0.182765 | 40.0 | 0.308713 | 0.047910 | 0.210200 | 0.281005 | 0.313996 | 0.345437 | 0.395579 |

| 21 | 40.0 | 0.034013 | 0.031098 | -0.029292 | 0.013257 | 0.033019 | 0.056213 | 0.100750 | 40.0 | 0.142778 | 0.035196 | 0.089118 | 0.103313 | 0.151955 | 0.172974 | 0.196788 | |

| 252 | 5 | 40.0 | 0.099102 | 0.146178 | -0.118797 | -0.035965 | 0.088972 | 0.240602 | 0.344110 | 40.0 | 0.226119 | 0.085731 | 0.057937 | 0.154616 | 0.235666 | 0.275010 | 0.403241 |

| 21 | 40.0 | -0.004490 | 0.070845 | -0.100003 | -0.059219 | -0.007356 | 0.033678 | 0.198329 | 40.0 | 0.175353 | 0.064942 | 0.074036 | 0.093632 | 0.202344 | 0.219997 | 0.280459 | |

| 756 | 5 | 40.0 | 0.186015 | 0.115528 | -0.008271 | 0.110150 | 0.192105 | 0.265226 | 0.460150 | 40.0 | 0.184398 | 0.117764 | 0.005263 | 0.063910 | 0.192105 | 0.283083 | 0.420301 |

| 21 | 40.0 | 0.201002 | 0.105924 | 0.005477 | 0.111770 | 0.197202 | 0.285152 | 0.395819 | 40.0 | 0.053943 | 0.033933 | 0.003493 | 0.023585 | 0.055524 | 0.073221 | 0.146188 | |

| 1260 | 5 | 40.0 | 0.433759 | 0.144668 | -0.111278 | 0.372932 | 0.475188 | 0.501128 | 0.658647 | 40.0 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 21 | 40.0 | 0.362641 | 0.080246 | 0.172502 | 0.317272 | 0.368462 | 0.428501 | 0.512524 | 40.0 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | |

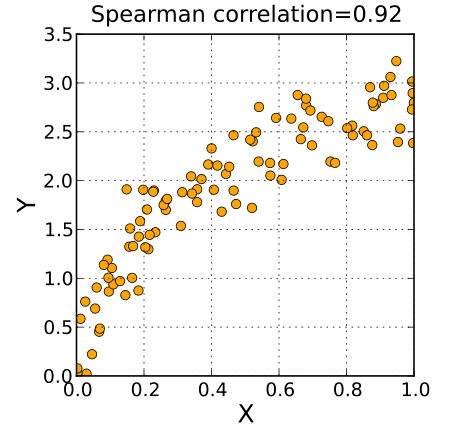

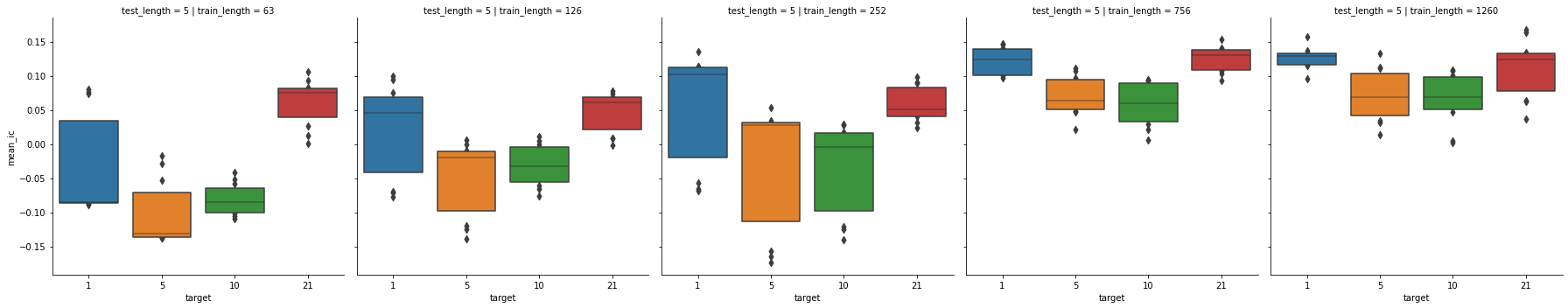

sns.catplot(x='target',

y='mean_ic',

col='train_length',

row='test_length',

data=cross_val_results[(cross_val_results.test_length == 5)],

kind='boxen')

<seaborn.axisgrid.FacetGrid at 0x7f74f9aa0490>

sns.catplot(x='target',

y='mean_ic',

col='train_length',

row='test_length',

data=cross_val_results[(cross_val_results.test_length == 21)],

kind='boxen')

<seaborn.axisgrid.FacetGrid at 0x7f74f90135e0>

As we can see the longer the train periods are the better, the mean_ic steadly grows as the train period grows. If

we look also to the test period the previous logic is still valid.

Regarding the standard deviation of the ic we can see a great decrease when the test length is longer, while the

train period doesn’t seem to affect positively the standard deviation.

hyperparam_res = cross_val_results.groupby(by=['n_estimators', 'max_depth', 'min_samples_leaf'])

hyperparam_res.describe()

| mean_ic | std_ic | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | mean | std | min | 25% | 50% | 75% | max | count | mean | std | min | 25% | 50% | 75% | max | |||

| n_estimators | max_depth | min_samples_leaf | ||||||||||||||||

| 100 | 5 | 5 | 40.0 | 0.066938 | 0.052099 | -0.058190 | 0.039183 | 0.075439 | 0.101053 | 0.156346 | 40.0 | 0.246668 | 0.067964 | 0.143428 | 0.188625 | 0.246664 | 0.313597 | 0.333802 |

| 25 | 40.0 | 0.073853 | 0.072692 | -0.133699 | 0.041800 | 0.088125 | 0.129480 | 0.179748 | 40.0 | 0.252279 | 0.076549 | 0.099890 | 0.188669 | 0.259033 | 0.323373 | 0.352929 | ||

| 100 | 40.0 | 0.018686 | 0.094137 | -0.174116 | -0.047659 | 0.011730 | 0.101930 | 0.190211 | 40.0 | 0.227733 | 0.090415 | 0.090941 | 0.121915 | 0.246673 | 0.311159 | 0.338839 | ||

| 15 | 5 | 40.0 | 0.067137 | 0.049123 | -0.052001 | 0.045625 | 0.076540 | 0.103037 | 0.153957 | 40.0 | 0.245776 | 0.066883 | 0.139524 | 0.185994 | 0.255743 | 0.306251 | 0.352641 | |

| 25 | 40.0 | 0.069342 | 0.070042 | -0.125135 | 0.033184 | 0.083357 | 0.122653 | 0.156643 | 40.0 | 0.252782 | 0.077793 | 0.110143 | 0.189705 | 0.261310 | 0.325075 | 0.364217 | ||

| 250 | 5 | 100 | 40.0 | 0.023609 | 0.098867 | -0.157054 | -0.051136 | 0.010491 | 0.102668 | 0.193948 | 40.0 | 0.229805 | 0.087395 | 0.101609 | 0.123763 | 0.257245 | 0.310763 | 0.337009 |

| 15 | 5 | 40.0 | 0.070288 | 0.046894 | -0.042150 | 0.047507 | 0.084765 | 0.099238 | 0.145002 | 40.0 | 0.251626 | 0.066471 | 0.145401 | 0.194981 | 0.253222 | 0.317341 | 0.346149 | |

| 25 | 40.0 | 0.071032 | 0.072196 | -0.137299 | 0.041237 | 0.079695 | 0.127785 | 0.158759 | 40.0 | 0.251367 | 0.075597 | 0.100953 | 0.188811 | 0.260109 | 0.326533 | 0.337836 | ||

| 100 | 40.0 | 0.020583 | 0.097593 | -0.164422 | -0.048372 | 0.005453 | 0.101662 | 0.183224 | 40.0 | 0.229869 | 0.090323 | 0.092126 | 0.124280 | 0.250908 | 0.313082 | 0.345137 | ||

By giving a first look to the hyperparameters results, we can see that a larger number of estimators

often gives better ic, while is not really clear what kind of impact the others two parameters have.

It seems like that a lower number of sample for each leaf often gives a greater ic. Let’s see if that it is true by

seeing which combination of parameters gives the highest mean ic.

hyperparam_res.apply(lambda x : x.nlargest(3, 'mean_ic')).drop(['n_estimators', 'max_depth', 'min_samples_leaf'], axis=1)

| train_length | test_length | mean_ic | std_ic | rounds | target | ||||

|---|---|---|---|---|---|---|---|---|---|

| n_estimators | max_depth | min_samples_leaf | |||||||

| 100 | 5 | 5 | 317 | 1260 | 21 | 0.156346 | 0.186483 | 24 | 21 |

| 327 | 756 | 5 | 0.139911 | 0.322106 | 100 | 21 | |||

| 17 | 1260 | 21 | 0.132851 | 0.181271 | 24 | 1 | |||

| 25 | 319 | 1260 | 21 | 0.179748 | 0.187960 | 24 | 21 | ||

| 339 | 756 | 21 | 0.161495 | 0.188905 | 24 | 21 | |||

| 39 | 756 | 21 | 0.158831 | 0.194077 | 24 | 1 | |||

| 100 | 310 | 1260 | 21 | 0.190211 | 0.215878 | 24 | 21 | ||

| 210 | 1260 | 21 | 0.160654 | 0.210699 | 24 | 10 | |||

| 10 | 1260 | 21 | 0.159081 | 0.182454 | 24 | 1 | |||

| 15 | 5 | 55 | 252 | 21 | 0.153957 | 0.178335 | 24 | 1 | |

| 35 | 756 | 21 | 0.127312 | 0.176854 | 24 | 1 | |||

| 25 | 756 | 5 | 0.122724 | 0.281899 | 100 | 1 | |||

| 25 | 334 | 756 | 21 | 0.156643 | 0.191982 | 24 | 21 | ||

| 34 | 756 | 21 | 0.156446 | 0.196219 | 24 | 1 | |||

| 14 | 1260 | 21 | 0.145568 | 0.173556 | 24 | 1 | |||

| 250 | 5 | 100 | 116 | 1260 | 21 | 0.193948 | 0.221515 | 24 | 5 |

| 16 | 1260 | 21 | 0.186957 | 0.214005 | 24 | 1 | |||

| 316 | 1260 | 21 | 0.186653 | 0.224417 | 24 | 21 | |||

| 15 | 5 | 23 | 756 | 5 | 0.145002 | 0.274168 | 100 | 1 | |

| 53 | 252 | 21 | 0.139733 | 0.194309 | 24 | 1 | |||

| 43 | 252 | 5 | 0.134798 | 0.290483 | 100 | 1 | |||

| 25 | 312 | 1260 | 21 | 0.158759 | 0.217793 | 24 | 21 | ||

| 32 | 756 | 21 | 0.157359 | 0.171184 | 24 | 1 | |||

| 322 | 756 | 5 | 0.152640 | 0.331508 | 100 | 21 | |||

| 100 | 11 | 1260 | 21 | 0.183224 | 0.208548 | 24 | 1 | ||

| 311 | 1260 | 21 | 0.176749 | 0.233334 | 24 | 21 | |||

| 111 | 1260 | 21 | 0.172912 | 0.223386 | 24 | 5 |

From the table above we can see that the combinations which gives the best results are {'n_estimators': 100, 'max_depth':5, 'min_samples_leaf': 100} and

{'n_estimators': 250, 'max_depth':5, 'min_samples_leaf': 100}.

n_estimators parameter doesn’t seem to make a big difference in the model, since the result that

we get from the combinations cited above are almost the same, indeed the model with fewer trees performs better

than the one with more trees.

res_target = cross_val_results.groupby(by='target')

res_target.describe()

| mean_ic | std_ic | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | mean | std | min | 25% | 50% | 75% | max | count | mean | std | min | 25% | 50% | 75% | max | |

| target | ||||||||||||||||

| 1 | 100.0 | 0.066426 | 0.082785 | -0.088416 | -0.030319 | 0.098984 | 0.127388 | 0.186957 | 100.0 | 0.232965 | 0.076905 | 0.099890 | 0.174340 | 0.245204 | 0.301679 | 0.341082 |

| 5 | 100.0 | 0.031137 | 0.085663 | -0.174116 | -0.021445 | 0.054681 | 0.093263 | 0.193948 | 100.0 | 0.243519 | 0.074021 | 0.106925 | 0.188271 | 0.245934 | 0.310896 | 0.363679 |

| 10 | 100.0 | 0.037146 | 0.073816 | -0.139836 | -0.003876 | 0.048050 | 0.092977 | 0.169536 | 100.0 | 0.252171 | 0.077760 | 0.108536 | 0.190572 | 0.263291 | 0.325020 | 0.359887 |

| 21 | 100.0 | 0.087047 | 0.050165 | -0.012699 | 0.057481 | 0.091125 | 0.119924 | 0.190211 | 100.0 | 0.248214 | 0.082655 | 0.090941 | 0.184616 | 0.264477 | 0.323795 | 0.364217 |

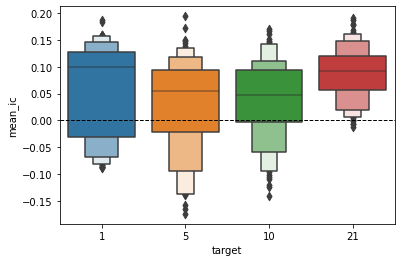

ax = sns.boxenplot(x='target', y='mean_ic', data=cross_val_results)

ax.axhline(0, ls='--', lw=1, c='k')

<matplotlib.lines.Line2D at 0x7f74f8d720d0>

Now that we’ve grouped by target (the lookhead of our model) let’s see that our previous hypothesis about the best hyperparameters that we’ve done before are confirmed.

res_target.apply(lambda x: x.nlargest(3, 'mean_ic')).drop('target', axis=1)

| train_length | test_length | n_estimators | max_depth | min_samples_leaf | mean_ic | std_ic | rounds | ||

|---|---|---|---|---|---|---|---|---|---|

| target | |||||||||

| 1 | 16 | 1260 | 21 | 250 | 5 | 100 | 0.186957 | 0.214005 | 24 |

| 11 | 1260 | 21 | 250 | 15 | 100 | 0.183224 | 0.208548 | 24 | |

| 10 | 1260 | 21 | 100 | 5 | 100 | 0.159081 | 0.182454 | 24 | |

| 5 | 116 | 1260 | 21 | 250 | 5 | 100 | 0.193948 | 0.221515 | 24 |

| 111 | 1260 | 21 | 250 | 15 | 100 | 0.172912 | 0.223386 | 24 | |

| 110 | 1260 | 21 | 100 | 5 | 100 | 0.149622 | 0.213381 | 24 | |

| 10 | 211 | 1260 | 21 | 250 | 15 | 100 | 0.169536 | 0.224359 | 24 |

| 216 | 1260 | 21 | 250 | 5 | 100 | 0.167021 | 0.218431 | 24 | |

| 210 | 1260 | 21 | 100 | 5 | 100 | 0.160654 | 0.210699 | 24 | |

| 21 | 310 | 1260 | 21 | 100 | 5 | 100 | 0.190211 | 0.215878 | 24 |

| 316 | 1260 | 21 | 250 | 5 | 100 | 0.186653 | 0.224417 | 24 | |

| 319 | 1260 | 21 | 100 | 5 | 25 | 0.179748 | 0.187960 | 24 |

res_std = cross_val_results[cross_val_results.std_ic != 0.0].groupby(by='target')

res_std.apply(lambda x: x.nsmallest(3, 'std_ic')).drop('target', axis=1)

| train_length | test_length | n_estimators | max_depth | min_samples_leaf | mean_ic | std_ic | rounds | ||

|---|---|---|---|---|---|---|---|---|---|

| target | |||||||||

| 1 | 99 | 63 | 21 | 100 | 5 | 25 | -0.040090 | 0.099890 | 24 |

| 98 | 63 | 21 | 250 | None | 25 | -0.049312 | 0.100781 | 24 | |

| 92 | 63 | 21 | 250 | 15 | 25 | -0.048031 | 0.100953 | 24 | |

| 5 | 151 | 252 | 21 | 250 | 15 | 100 | -0.032405 | 0.106925 | 24 |

| 150 | 252 | 21 | 100 | 5 | 100 | -0.021299 | 0.115925 | 24 | |

| 156 | 252 | 21 | 250 | 5 | 100 | -0.029880 | 0.118468 | 24 | |

| 10 | 296 | 63 | 21 | 250 | 5 | 100 | 0.012607 | 0.108536 | 24 |

| 250 | 252 | 21 | 100 | 5 | 100 | -0.009350 | 0.112099 | 24 | |

| 271 | 126 | 21 | 250 | 15 | 100 | 0.004410 | 0.114365 | 24 | |

| 21 | 350 | 252 | 21 | 100 | 5 | 100 | -0.012699 | 0.090941 | 24 |

| 391 | 63 | 21 | 250 | 15 | 100 | 0.015370 | 0.092126 | 24 | |

| 351 | 252 | 21 | 250 | 15 | 100 | -0.006404 | 0.095580 | 24 |

From the table above we can see that one of the two best models that we’ve identified before appears three out of the four times in the ranking of the first 3 models.

The hyperparameters of the best model are:

{'n_estimators': 250, 'max_depth':5, 'min_samples_leaf': 100, train_length: 1260, test_length:21}

base_params = rf_reg.get_params()

model = RandomForestRegressor(base_params)

model_params = {

'n_estimators': 250,

'max_depth': 5,

'max_features': 'log2',

'min_samples_leaf': 100

}

model = model.set_params(**model_params)

opt_test_length = 21

opt_train_length = 1260

scores = np.array([])

for lookahead in lookaheads:

n_splits = int(2 * YEAR / opt_test_length)

cv = MultipleTimeSeriesCV(

n_splits=n_splits,

test_period_length=opt_test_length,

train_period_length=opt_train_length,

lookahead=lookahead

)

for i, (train_idx, test_idx) in enumerate(cv.split(X)):

model = model.fit(X.iloc[train_idx], y[f'target_{lookahead}d'].iloc[train_idx])

y_test = y[f'target_{lookahead}d'].iloc[test_idx]

y_pred = model.predict(X.iloc[test_idx])

scores = np.append(scores, rank_correl(y_test, y_pred))

print(f'Lookhead: {lookahead} | Iteration: {i} | Val score: {scores[-1]}')

Lookhead: 1 | Iteration: 0 | Val score: 0.4090909090909091

Lookhead: 1 | Iteration: 1 | Val score: 0.40389610389610386

Lookhead: 1 | Iteration: 2 | Val score: 0.18571428571428572

Lookhead: 1 | Iteration: 3 | Val score: -0.6935064935064935

Lookhead: 1 | Iteration: 4 | Val score: 0.0038961038961038965

Lookhead: 1 | Iteration: 5 | Val score: 0.08571428571428572

Lookhead: 1 | Iteration: 6 | Val score: -0.00909090909090909

Lookhead: 1 | Iteration: 7 | Val score: 0.24285714285714283

Lookhead: 1 | Iteration: 8 | Val score: 0.10519480519480517

Lookhead: 1 | Iteration: 9 | Val score: 0.051948051948051945

Lookhead: 1 | Iteration: 10 | Val score: -0.14155844155844155

Lookhead: 1 | Iteration: 11 | Val score: 0.02727272727272727

Lookhead: 1 | Iteration: 12 | Val score: 0.49870129870129876

Lookhead: 1 | Iteration: 13 | Val score: 0.174025974025974

Lookhead: 1 | Iteration: 14 | Val score: 0.24675324675324672

Lookhead: 1 | Iteration: 15 | Val score: -0.17662337662337665

Lookhead: 1 | Iteration: 16 | Val score: 0.3922077922077922

Lookhead: 1 | Iteration: 17 | Val score: 0.20649350649350648

Lookhead: 1 | Iteration: 18 | Val score: 0.1526469713505688

Lookhead: 1 | Iteration: 19 | Val score: 0.2922077922077922

Lookhead: 1 | Iteration: 20 | Val score: 0.2558441558441559

Lookhead: 1 | Iteration: 21 | Val score: 0.12857142857142856

Lookhead: 1 | Iteration: 22 | Val score: -0.08181818181818182

Lookhead: 1 | Iteration: 23 | Val score: -0.012987012987012986

Lookhead: 5 | Iteration: 0 | Val score: 0.7077922077922078

Lookhead: 5 | Iteration: 1 | Val score: 0.35974025974025975

Lookhead: 5 | Iteration: 2 | Val score: 0.04805194805194805

Lookhead: 5 | Iteration: 3 | Val score: -0.42727272727272725

Lookhead: 5 | Iteration: 4 | Val score: -0.2324675324675325

Lookhead: 5 | Iteration: 5 | Val score: 0.21168831168831168

Lookhead: 5 | Iteration: 6 | Val score: 0.28441558441558445

Lookhead: 5 | Iteration: 7 | Val score: 0.007792207792207793

Lookhead: 5 | Iteration: 8 | Val score: 0.6792207792207793

Lookhead: 5 | Iteration: 9 | Val score: 0.1669373261153029

Lookhead: 5 | Iteration: 10 | Val score: 0.7285714285714285

Lookhead: 5 | Iteration: 11 | Val score: 0.4209159039794407

Lookhead: 5 | Iteration: 12 | Val score: -0.00909090909090909

Lookhead: 5 | Iteration: 13 | Val score: 0.7216629156190721

Lookhead: 5 | Iteration: 14 | Val score: 0.7545454545454545

Lookhead: 5 | Iteration: 15 | Val score: -0.3090909090909091

Lookhead: 5 | Iteration: 16 | Val score: -0.05584415584415584

Lookhead: 5 | Iteration: 17 | Val score: -0.6597402597402597

Lookhead: 5 | Iteration: 18 | Val score: -0.13376623376623376

Lookhead: 5 | Iteration: 19 | Val score: 0.5857142857142857

Lookhead: 5 | Iteration: 20 | Val score: 0.44285714285714284

Lookhead: 5 | Iteration: 21 | Val score: 0.44415584415584414

Lookhead: 5 | Iteration: 22 | Val score: 0.13116883116883118

Lookhead: 5 | Iteration: 23 | Val score: 0.464935064935065

Lookhead: 10 | Iteration: 0 | Val score: 0.46753246753246747

Lookhead: 10 | Iteration: 1 | Val score: 0.28515753371446684

Lookhead: 10 | Iteration: 2 | Val score: 0.06883116883116883

Lookhead: 10 | Iteration: 3 | Val score: 0.3233766233766234

Lookhead: 10 | Iteration: 4 | Val score: -0.6649350649350649

Lookhead: 10 | Iteration: 5 | Val score: 0.7103896103896103

Lookhead: 10 | Iteration: 6 | Val score: -0.06623376623376624

Lookhead: 10 | Iteration: 7 | Val score: 0.6883116883116883

Lookhead: 10 | Iteration: 8 | Val score: 0.6727272727272726

Lookhead: 10 | Iteration: 9 | Val score: 0.1155844155844156

Lookhead: 10 | Iteration: 10 | Val score: 0.212987012987013

Lookhead: 10 | Iteration: 11 | Val score: 0.7870129870129869

Lookhead: 10 | Iteration: 12 | Val score: 0.35194805194805195

Lookhead: 10 | Iteration: 13 | Val score: 0.9090967485564111

Lookhead: 10 | Iteration: 14 | Val score: 0.8285714285714286

Lookhead: 10 | Iteration: 15 | Val score: 0.14805194805194805

Lookhead: 10 | Iteration: 16 | Val score: 0.36363636363636365

Lookhead: 10 | Iteration: 17 | Val score: -0.7727272727272727

Lookhead: 10 | Iteration: 18 | Val score: -0.425974025974026

Lookhead: 10 | Iteration: 19 | Val score: 0.8363636363636363

Lookhead: 10 | Iteration: 20 | Val score: 0.6077922077922078

Lookhead: 10 | Iteration: 21 | Val score: 0.8870129870129868

Lookhead: 10 | Iteration: 22 | Val score: 0.5012987012987012

Lookhead: 10 | Iteration: 23 | Val score: 0.6948051948051948

Lookhead: 21 | Iteration: 0 | Val score: 0.15974025974025974

Lookhead: 21 | Iteration: 1 | Val score: 0.6987012987012987

Lookhead: 21 | Iteration: 2 | Val score: 0.7792207792207791

Lookhead: 21 | Iteration: 3 | Val score: 0.8597402597402597

Lookhead: 21 | Iteration: 4 | Val score: 0.6142857142857143

Lookhead: 21 | Iteration: 5 | Val score: 0.8818181818181818

Lookhead: 21 | Iteration: 6 | Val score: 0.748051948051948

Lookhead: 21 | Iteration: 7 | Val score: 0.3571428571428571

Lookhead: 21 | Iteration: 8 | Val score: 0.7454545454545455

Lookhead: 21 | Iteration: 9 | Val score: 0.47792207792207797

Lookhead: 21 | Iteration: 10 | Val score: -0.5443909635684095

Lookhead: 21 | Iteration: 11 | Val score: 0.6727272727272726

Lookhead: 21 | Iteration: 12 | Val score: 0.7376623376623377

Lookhead: 21 | Iteration: 13 | Val score: 0.8066302176364907

Lookhead: 21 | Iteration: 14 | Val score: 0.6012987012987013

Lookhead: 21 | Iteration: 15 | Val score: 0.8883116883116883

Lookhead: 21 | Iteration: 16 | Val score: 0.6233766233766234

Lookhead: 21 | Iteration: 17 | Val score: 0.7831168831168831

Lookhead: 21 | Iteration: 18 | Val score: -0.033766233766233764

Lookhead: 21 | Iteration: 19 | Val score: 0.8376623376623376

Lookhead: 21 | Iteration: 20 | Val score: -0.10389610389610389

Lookhead: 21 | Iteration: 21 | Val score: 0.7610389610389611

Lookhead: 21 | Iteration: 22 | Val score: 0.12467532467532469

Lookhead: 21 | Iteration: 23 | Val score: 0.5898019148353892

import pickle

save_model = False

load_model = True

pkl_filename = "./fine_tune_rf.pkl"

if save_model:

with open(pkl_filename, 'wb') as file:

pickle.dump(model, file)

if load_model:

with open(pkl_filename, 'rb') as file:

model = pickle.load(file)

Evaluate the Best Model

y_test = data.filter(like='target').loc['2019': '2021']

print(rank_correl(model.predict(X_test.iloc[-30:]), y_test.target_1d.values[-30:]))

-0.10658965553308332

print(rank_correl(model.predict(X_test.iloc[-30:]), y_test.target_5d.values[-30:]))

0.07804681890497733

print(rank_correl(model.predict(X_test.iloc[-30:]), y_test.target_10d.values[-30:]))

0.37908454896703275

print(rank_correl(model.predict(X_test.iloc[-30:]), y_test.target_21d.values[-30:]))

0.4245746948430766

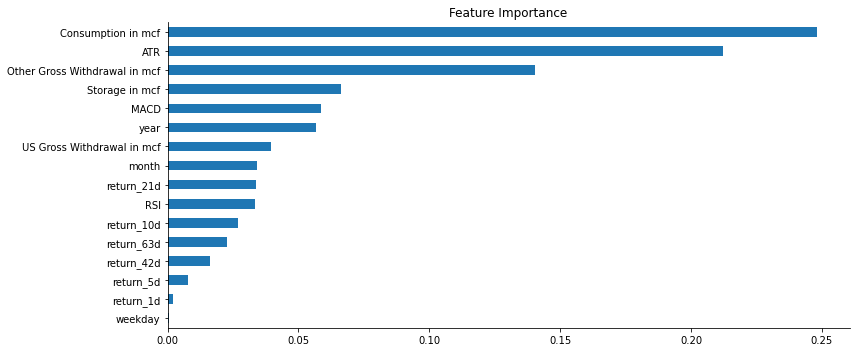

Parameters importance

Let’s now explore what are the most important features that our model uses to make his predictions.

fig, ax = plt.subplots(figsize=(12,5))

(pd.Series(model.feature_importances_, index=X.columns)

.sort_values(ascending=False)

.iloc[:20]

.sort_values()

.plot.barh(ax=ax, title='Feature Importance'))

sns.despine()

fig.tight_layout();

Using the builtin features_importances_ attribute from our model we can see that the most impactful params are:

- ATR

- NG consumption

- Other States Gross Withdrawal

- US Gross Withdrawal

- year

- MACD

To have a more holistic view of the importance of the features, we can use two others functions provided by

sklearn: permutation_importance and partial_dependence.

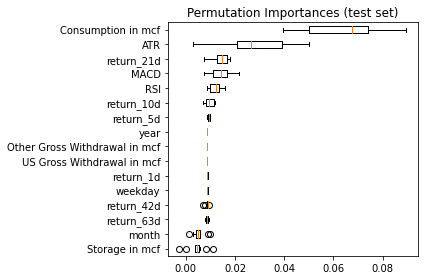

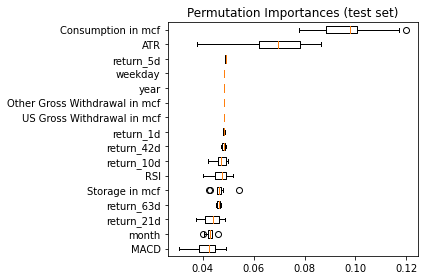

from sklearn.inspection import permutation_importance, partial_dependence

result = permutation_importance(model, X_test, y_test.target_21d, n_repeats=10, n_jobs=-1, max_samples=0.3)

sorted_idx = result.importances_mean.argsort()

fig, ax = plt.subplots()

ax.boxplot(result.importances[sorted_idx].T,

vert=False, labels=X.columns[sorted_idx])

ax.set_title("Permutation Importances (test set)")

fig.tight_layout()

plt.show()

result = permutation_importance(model, X_test, y_test.target_21d, n_repeats=10, n_jobs=-1, max_samples=0.3)

sorted_idx = result.importances_mean.argsort()

fig, ax = plt.subplots()

ax.boxplot(result.importances[sorted_idx].T,

vert=False, labels=X.columns[sorted_idx])

ax.set_title("Permutation Importances (test set)")

fig.tight_layout()

plt.show()

Partial dependence

Partial dependence plots (PDP) show the dependence between the target response and a set of input features of interest, marginalizing over the values of all other input features (the ‘complement’ features). Intuitively, we can interpret the partial dependence as the expected target response as a function of the input features of interest.

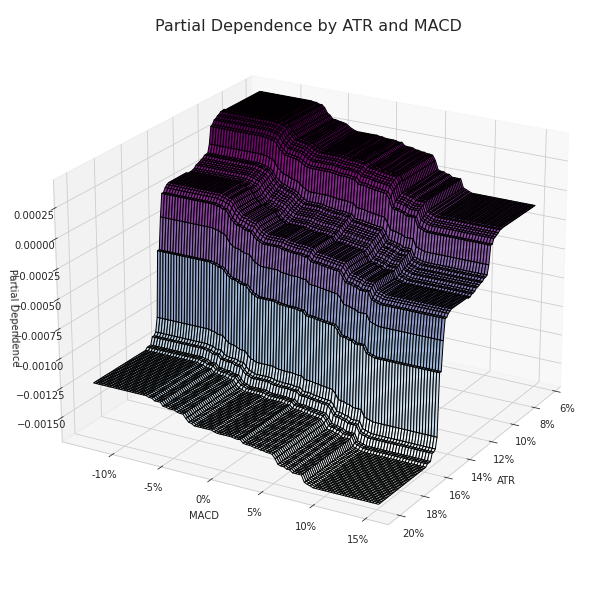

Partial dependence between the ATR and MACD

What is really significant in the image below is the gap in the partial dependence values when the approaches values between 0.16 and 0.14.

sns.set_style('whitegrid')

targets = ['ATR', 'MACD']

pdp, axes = partial_dependence(estimator=model,

features=targets,

X=X_test,

grid_resolution=100)

XX, YY = np.meshgrid(axes[0], axes[1])

Z = pdp[0].reshape(list(map(np.size, axes))).T

fig = plt.figure(figsize=(14, 8))

ax = Axes3D(fig)

surface = ax.plot_surface(XX, YY, Z,

rstride=1,

cstride=1,

cmap=plt.cm.BuPu,

edgecolor='k')

ax.set_xlabel('ATR')

ax.set_ylabel('MACD')

ax.set_zlabel('Partial Dependence')

ax.view_init(elev=22, azim=30)

ax.yaxis.set_major_formatter(FuncFormatter(lambda y, _: '{:.0%}'.format(y)))

ax.xaxis.set_major_formatter(FuncFormatter(lambda y, _: '{:.0%}'.format(y)))

# fig.colorbar(surface)

fig.suptitle('Partial Dependence by ATR and MACD', fontsize=16)

fig.tight_layout()

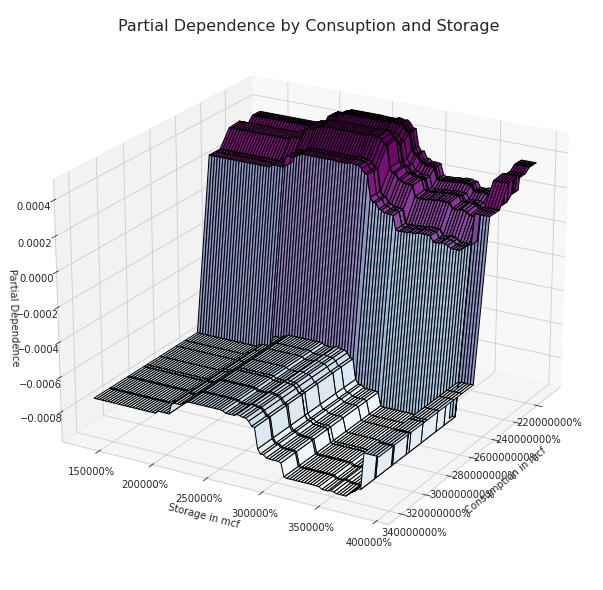

Partial dependence between the Consumption and Storage

sns.set_style('whitegrid')

targets = ['Consumption in mcf', 'Storage in mcf']

pdp, axes = partial_dependence(estimator=model,

features=targets,

X=X_test,

grid_resolution=100)

XX, YY = np.meshgrid(axes[0], axes[1])

Z = pdp[0].reshape(list(map(np.size, axes))).T

fig = plt.figure(figsize=(14, 8))

ax = Axes3D(fig)

surface = ax.plot_surface(XX, YY, Z,

rstride=1,

cstride=1,

cmap=plt.cm.BuPu,

edgecolor='k')

ax.set_xlabel('Consumption in mcf')

ax.set_ylabel('Storage in mcf')

ax.set_zlabel('Partial Dependence')

ax.view_init(elev=22, azim=30)

ax.yaxis.set_major_formatter(FuncFormatter(lambda y, _: '{:.0%}'.format(y)))

ax.xaxis.set_major_formatter(FuncFormatter(lambda y, _: '{:.0%}'.format(y)))

# fig.colorbar(surface)

fig.suptitle('Partial Dependence by Consuption and Storage', fontsize=16)

fig.tight_layout()

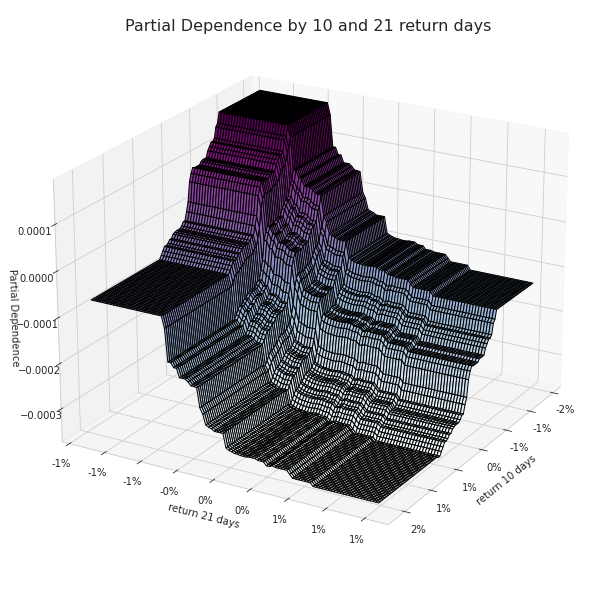

Partial Dependence between 10 and 21 return days

sns.set_style('whitegrid')

targets = ['return_10d', 'return_21d']

pdp, axes = partial_dependence(estimator=model,

features=targets,

X=X_test,

grid_resolution=100)

XX, YY = np.meshgrid(axes[0], axes[1])

Z = pdp[0].reshape(list(map(np.size, axes))).T

fig = plt.figure(figsize=(14, 8))

ax = Axes3D(fig)

ax.plot_surface(XX, YY, Z,

rstride=1,

cstride=1,

cmap=plt.cm.BuPu,

edgecolor='k')

ax.set_xlabel('return 10 days')

ax.set_ylabel('return 21 days')

ax.set_zlabel('Partial Dependence')

ax.view_init(elev=22, azim=30)

ax.yaxis.set_major_formatter(FuncFormatter(lambda y, _: '{:.0%}'.format(y)))

ax.xaxis.set_major_formatter(FuncFormatter(lambda y, _: '{:.0%}'.format(y)))

fig.suptitle('Partial Dependence by 10 and 21 return days', fontsize=16)

fig.tight_layout()

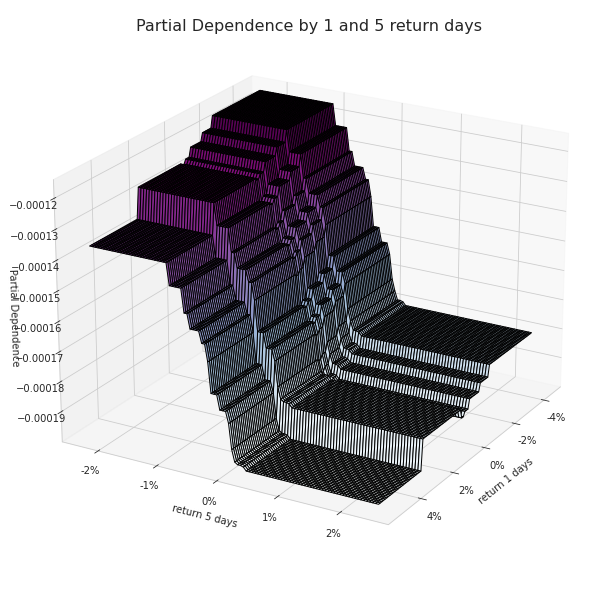

Partial Dependence between 1 and 5 return days

sns.set_style('whitegrid')

targets = ['return_1d', 'return_5d']

pdp, axes = partial_dependence(estimator=model,

features=targets,

X=X_test,

grid_resolution=100)

XX, YY = np.meshgrid(axes[0], axes[1])

Z = pdp[0].reshape(list(map(np.size, axes))).T

fig = plt.figure(figsize=(14, 8))

ax = Axes3D(fig)

ax.plot_surface(XX, YY, Z,

rstride=1,

cstride=1,

cmap=plt.cm.BuPu,

edgecolor='k')

ax.set_xlabel('return 1 days')

ax.set_ylabel('return 5 days')

ax.set_zlabel('Partial Dependence')

ax.view_init(elev=22, azim=30)

ax.yaxis.set_major_formatter(FuncFormatter(lambda y, _: '{:.0%}'.format(y)))

ax.xaxis.set_major_formatter(FuncFormatter(lambda y, _: '{:.0%}'.format(y)))

fig.suptitle('Partial Dependence by 1 and 5 return days', fontsize=16)

fig.tight_layout()

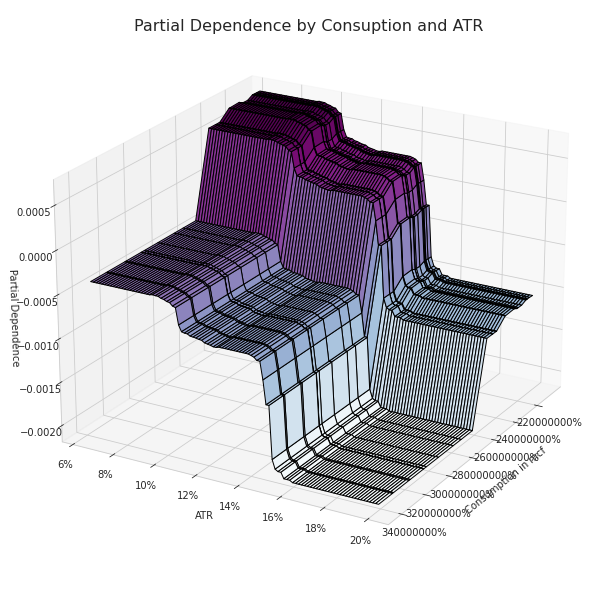

Partial Dependence between NG Consuption and ATR

sns.set_style('whitegrid')

targets = ['Consumption in mcf', 'ATR']

pdp, axes = partial_dependence(estimator=model,

features=targets,

X=X_test,

grid_resolution=100)

XX, YY = np.meshgrid(axes[0], axes[1])

Z = pdp[0].reshape(list(map(np.size, axes))).T

fig = plt.figure(figsize=(14, 8))

ax = Axes3D(fig)

ax.plot_surface(XX, YY, Z,

rstride=1,

cstride=1,

cmap=plt.cm.BuPu,

edgecolor='k')

ax.set_xlabel('Consumption in mcf')

ax.set_ylabel('ATR')

ax.set_zlabel('Partial Dependence')

ax.view_init(elev=22, azim=30)

ax.yaxis.set_major_formatter(FuncFormatter(lambda y, _: '{:.0%}'.format(y)))

ax.xaxis.set_major_formatter(FuncFormatter(lambda y, _: '{:.0%}'.format(y)))

fig.suptitle('Partial Dependence by Consuption and ATR', fontsize=16)

fig.tight_layout()

Comparing the two most important features identified before (the ATR and the Consumption) we can clearly we can see not only higher partial dependence values but also a well-defined pattern. As the ATR and the Consuption are approaching lower values the partial dependence grows, the opposite happens when the opposite conditions occur.

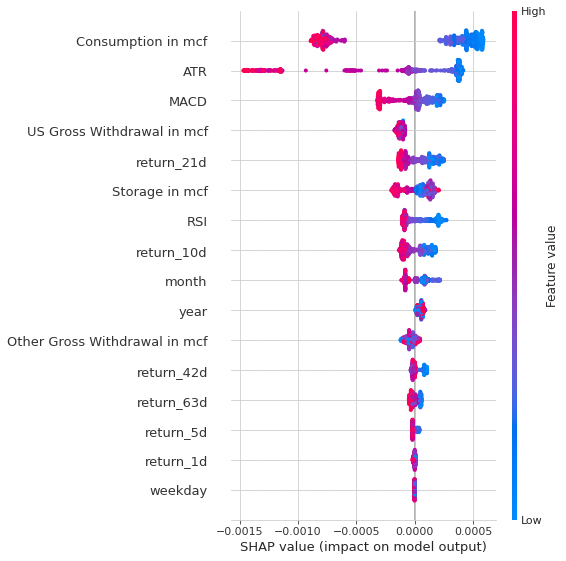

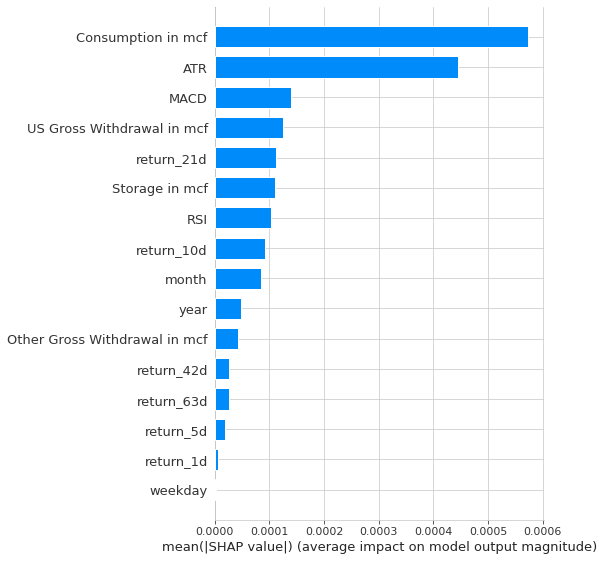

Shap Values

Shapley values originated in game theory as a technique for assigning a value to each player in a collaborative game that reflects their contribution to the team’s success. SHAP values are an adaptation of the game theory concept to tree-based models and are calculated for each feature and each sample. They measure how a feature contributes to the model output for a given observation. For this reason, SHAP values provide differentiated insights into how the impact of a feature varies across samples, which is important given the role of interaction effects in these nonlinear models.

Shapley values are computed by introducing each feature, one at a time, into a conditional expectation function of the model’s output, \(f_x(S) = \mathbb{E}[f(X) | do(X_s = x_s)]\), and attributing the change produced at each step to the feature that was introduced; then averaging this process over all possible feature orderings.

import shap

explainer = shap.TreeExplainer(model)

shap_values = explainer.shap_values(X=X_test)

shap.summary_plot(shap_values, X_test, show=False)

plt.tight_layout()

shap.summary_plot(shap_values, X_test, plot_type="bar",show=False)

plt.tight_layout()

The Shap values that we are seeing in the two images are confirming the most important features that we’ve identified before, which are: ATR, Consumption, Other Gross Withdrawal, US Gross Withdrawal, year and the MACD.

What Shap values are telling us more is how each feature is positively/negatively impact the output. We can see from the first picture that:

- lower values of ATR usually lead to better returns, while when the ATR is higher the opposite tend to happend

- we can say the same thing about the Consumption

- earlier months often yield to worse result

- lower values of MACD are positively correlated to higher model output values, like the atr

- US Gross Withdrawal Values that have highly deviated from the mean tend to yield to positive returns, while closer values to mean often yield negative returns

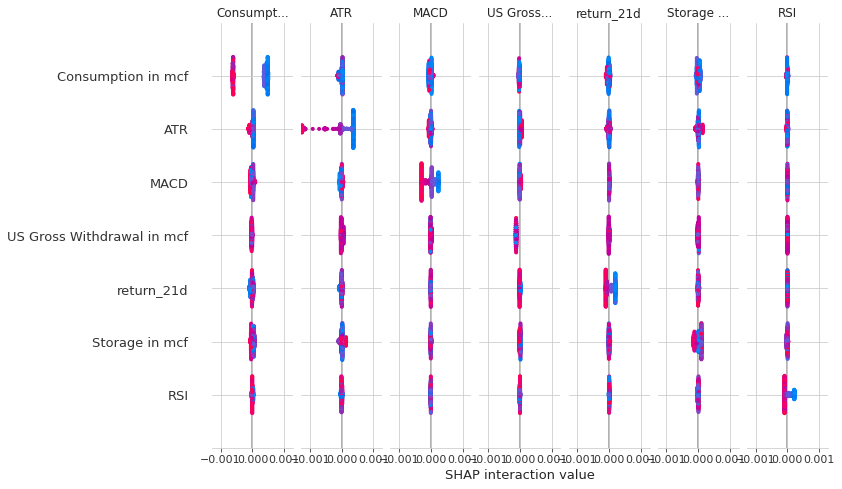

shap_interaction_values = explainer.shap_interaction_values(X_test)

shap.summary_plot(shap_interaction_values, X_test)

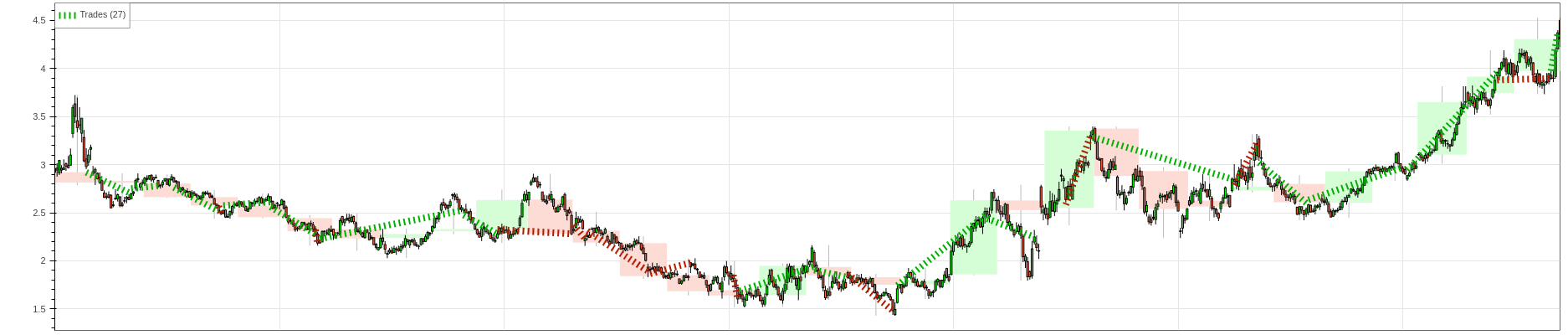

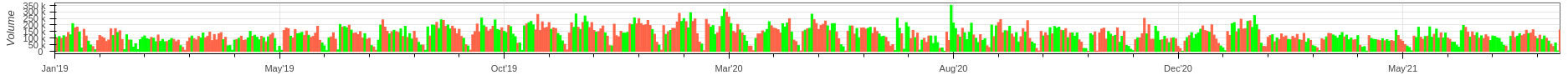

Backtesting

Now that we trained and evaluated the most important features of our model let’s use it in a trading strategy on the natural gas futures.

The strategy that I’m going to implement is the following:

Since the model has been trained to predict the return of the next n days I’m going to use a window of predictions (for instance a 10-day window) and I’m going to look for a peak positive or negative in that window of predictions. Once I’ve identified the peak, if the peak is positive I’m going to submit a buy order, while if the peak is negative I’m going to submit a sell order.

So, what I’m doing is to leverage the forecast of the model for the next period to submit an order.

The money management and risk management rule that the startegy is going to use are the following:

- Money management: 5% of the total equity per trade

- Risk management: a trailing stop that is looking at the low of the third previous day and subtact the current atr multiplied by 1.5

Let’s see how it works in practice.

Little Discaimer: the backtesting engine that I’ve used treat futures like a stock so don’t expect the results to be real, because it doesn’t take into account all the varibles that you should look for when trading futures. This strategy is only for didactical purpouse.

backtest_data = data.loc['2019':'2021']

import math

from scipy.signal import find_peaks

from backtesting import Backtest, Strategy

import tulipy as tu

def return_indicator(values, data_len: int):

a = np.empty((data_len - len(values),))

a[:] = np.nan

return np.concatenate([a, values])

def get_atr(data: pd.DataFrame, n: int):

atr = tu.atr(data.High, data.Low, data.Close, n)

return return_indicator(atr, len(data))

class RFModelStrategy(Strategy):

risk = 5 # 5% of the total amount per trade

pred_len = 18

atr_stop_multiplier = 1.5

trailingATRLen = 5

def init(self):

super(RFModelStrategy, self).init()

self.lookback = 3

self.pointvalue = 10

self.model = model

self.atr = self.I(get_atr, self.data, 14, plot=False)

self.trailingAtr = self.I(get_atr, self.data, self.trailingATRLen, plot=False)

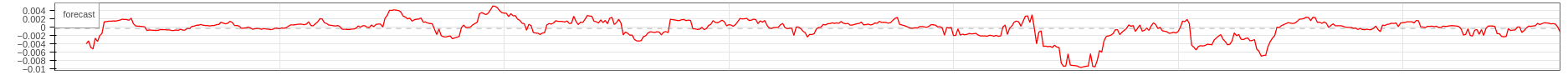

self.forecasts = self.I(lambda: np.repeat(np.nan, len(self.data)), name='forecast', color='red')

def get_signal(self, predictions):

if np.sum(predictions < 0, axis=0) / self.pred_len > 0.75:

neg_peaks, _ = find_peaks(-predictions, width=2)

if len(neg_peaks) != 0:

return 'Sell'

elif np.sum(predictions > 0, axis=0) / self.pred_len > 0.75:

peaks, _ = find_peaks(predictions, width=2)

if len(peaks) != 0:

return 'Buy'

return 'No signal'

def next(self):

X, _ = get_X_y(self.data.df)

predictions = self.model.predict(X[-self.pred_len:])

self.forecasts[-1] = self.model.predict(X[-2:])[0]

if len(self.trades) == 0:

signal = self.get_signal(predictions)

if signal == 'Sell':

self.sell(size=self.get_position_size())

elif signal == 'Buy':

self.buy(size=self.get_position_size())

else:

signal = self.get_signal(predictions)

if self.trades[0].is_long:

if signal == 'Sell' or \

self.data.Low[-1] <= self.get_trailing_stop(long=True):

self.position.close()

if signal == 'Sell':

self.sell(size=self.get_position_size())

else:

if signal == 'Buy' or \

self.data.High[-1] >= self.get_trailing_stop(long=False):

self.position.close()

if signal == 'Buy':

self.buy(size=self.get_position_size())

def get_position_size(self):

return math.floor((self.risk / 100 * self.equity) / (self.atr * self.pointvalue))

def get_trailing_stop(self, long: bool):

if long:

return np.max(self.data.Low[-self.lookback:]) - self.trailingAtr[-1] * self.atr_stop_multiplier

else:

return np.min(self.data.High[-self.lookback:]) + self.trailingAtr[-1] * self.atr_stop_multiplier

bt = Backtest(backtest_data, RFModelStrategy, cash=250_000, trade_on_close=True, commission=0.02)

stats = bt.run()

stats

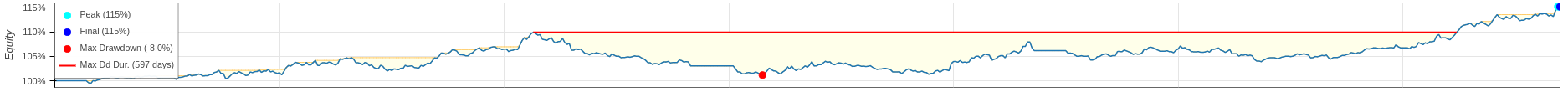

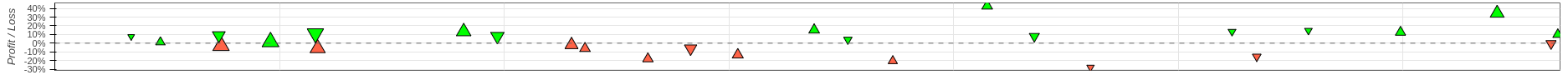

Start 2019-01-02 00:00:00

End 2021-08-30 00:00:00

Duration 971 days 00:00:00

Exposure Time [%] 91.95231

Equity Final [$] 288032.29994

Equity Peak [$] 288032.29994

Return [%] 15.21292

Buy & Hold Return [%] 45.537525

Return (Ann.) [%] 5.462319

Volatility (Ann.) [%] 5.324367

Sharpe Ratio 1.025909

Sortino Ratio 1.634402

Calmar Ratio 0.684179

Max. Drawdown [%] -7.983754

Avg. Drawdown [%] -0.844115

Max. Drawdown Duration 597 days 00:00:00

Avg. Drawdown Duration 31 days 00:00:00

# Trades 27

Win Rate [%] 59.259259

Best Trade [%] 42.785025

Worst Trade [%] -27.783283

Avg. Trade [%] 2.143391

Max. Trade Duration 94 days 00:00:00

Avg. Trade Duration 33 days 00:00:00

Profit Factor 1.743472

Expectancy [%] 3.260092

SQN 1.563307

_strategy RFModelStrategy

_equity_curve ...

_trades Size Entry...

dtype: object

bt.plot(filename='./tree_regressor_backtesting.html')

As we can see the strategy in the past two years is profitable, it has a decent rate of win rate (almost 60%), but it does not beat the buy and hold returns and the maximum drawdown duration is more than and year and a half(even though the maximum drawdown is 8%, which is pretty good).

References

- NHANES I Survival Model

- Long-Short Strategy, Part 4: How to interpret GBM results

- Preparing Alpha Factors and Features to predict Stock Returns

- Prediction stock returns with linear regression